Learning you have kidney disease can be overwhelming, something I found out myself while camping in 2003. It’s hard for patients to get the information they need about living with kidney disease, and for many patients the costs of treatment are excessive.

information they need about living with kidney disease, and for many patients the costs of treatment are excessive.

Starting on dialysis brought with it a lot of changes, one of them being that I had to cut back on my working hours. Kidney disease as a whole can make a person weak, and going through dialysis treatments for several hours multiple times a week can take a lot out of you. Because of that, though, I had to adopt Medicare as my primary insurance once I started on dialysis, and Medicare doesn’t cover the full cost of treatment on its own.

Luckily, living in Oklahoma at least has meant that I’ve been able to get coverage for the 20 percent of my dialysis treatments that Medicare doesn’t cover by itself. Patients in many other states who are under 65 can’t say the same, though, and have to find a way to pay for those costs on their own.

It isn’t just about dialysis treatments, either. A lot of dialysis patients also require a number of prescriptions to maintain a healthy blood pressure or manage conditions like diabetes or heart disease, all of which come with their own costs without access to proper coverage.

That could finally change if Congress passes H.R.1676, the Jack Reynolds Memorial Medigap Expansion Act. It would ensure that Medigap plans are both available and affordable to all patients at an affordable cost, lifting an enormous financial burden for patients and their families.

That alone won’t be enough, however. Congress also needs to pass legislation protecting patients’ access to their employer’s health insurance in the case that they are able to keep working once they start their treatments. For years, patients have been able to stay on their employer-provided coverage for up to 30 months before switching to Medicare as their primary insurance thanks to the Medicare Secondary Payer Act. A Supreme Court decision earlier this year, however, could open the door to those plans limiting the number of dialysis treatments they’ll cover, essentially forcing patients to switch to Medicare to receive life-saving dialysis treatments.

For many patients, that switch will come with enormous costs. In addition to covering a greater portion of dialysis than Medicare does on its own, employer plans usually cover important services that Medicare doesn’t at all. Dental care – which patients need in order to qualify for a kidney transplant – is just one example. Without coverage for those services, the costs quickly pile up and leave patients and their families with nowhere to turn.

More needs to be done to help patients so they have access not just to the information they need to live healthy lives on dialysis, but also to be able to afford dialysis in the first place. We need Oklahoma’s members of Congress, including Representatives Kevin Hern, Frank Lucas, and others to support legislation to fix these problems and ensure that patients here in Oklahoma and in every other state can afford essential care.

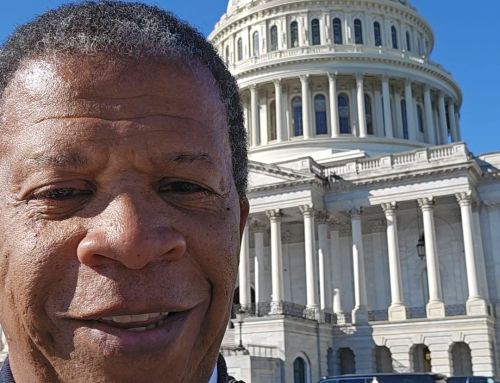

Eugene Blankenship, Gore, OK